how much is inheritance tax in wv

An immediate influx of cash. WV has no inheritance or estate tax.

A Guide To West Virginia Inheritance Laws

In the letter case the inheritance becomes subject to federal estate taxation with a progressive scale.

. No need to go through a bank for the. One both or neither could be a factor when someone dies. As previously mentioned the amount you owe depends on your relationship to the deceased.

This matter was most crucial for WV. Inheritance tax rates vary widely. Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is worth.

However state residents must remember to take into account the federal estate tax if their estate or the estate. When the inherited assets exceed your lifetime exemption of 1206 million. So the answer is 0.

There is no federal inheritance tax but there is a. Click the nifty map below to find the current rates. Inheritance tax rates differ by the state.

304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. In Washington State there is no inheritance tax.

No need to go through a loan approval process. Currently each individual may exempt from the gift tax up to 14000000 of gifts. Once you are married this amount doubles becoming 90000 every year.

Berkeley Springs WV 25411. Again this effectively means there is no federal gift tax imposed on the majority of Americans. Residents until 2005 when the state was imposing state.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Twelve states and the District of Columbia also charge estate taxes though the sizes of the. The tax rate varies.

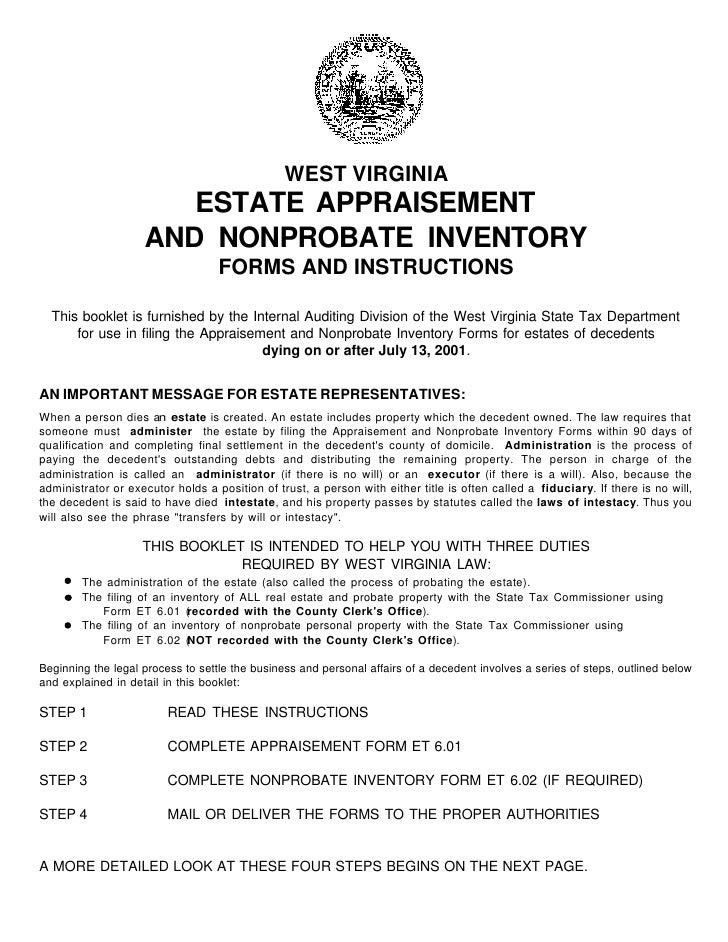

West Virginia collects neither an estate tax nor an inheritance tax. Kentucky Extended family pays from 4 percent on inheritances valued at 10000 up to 16 percent on those above 200000 with eight margins in between. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

Who has to pay. The advantages of an inheritance cash advance in West Virginia include. Effective Jan 1 2013 if Congress does nothing about the federalestate tax then the tax will returnto the status that.

As of 2021 the six states that charge an inheritance tax are. One option is convincing your relative to give you a portion of your inheritance money every year as a gift. Tax Information and Assistance.

In 2022 anyone can give another person up to 16000 within the. The first 1000 is exempt. Estate tax is the amount thats taken out of someones estate upon their death.

How Much Is the Inheritance Tax. These states have an inheritance tax. Based on the value of the estate 18 to 40 federal estate tax brackets apply.

How Is Tax Liability Calculated Common Tax Questions Answered

Gift Tax In West Virginia Rules Limits Exemptions

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Historical West Virginia Tax Policy Information Ballotpedia

States With No Estate Tax Or Inheritance Tax Plan Where You Die

West Virginia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State By State Comparison Where Should You Retire

How Is Tax Liability Calculated Common Tax Questions Answered

Et601602 State Wv Us Taxrev Taxdoc Tsd

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

A Guide To West Virginia Inheritance Laws

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

A Guide To West Virginia Inheritance Laws

State By State Comparison Where Should You Retire

West Virginia Estate Tax Everything You Need To Know Smartasset